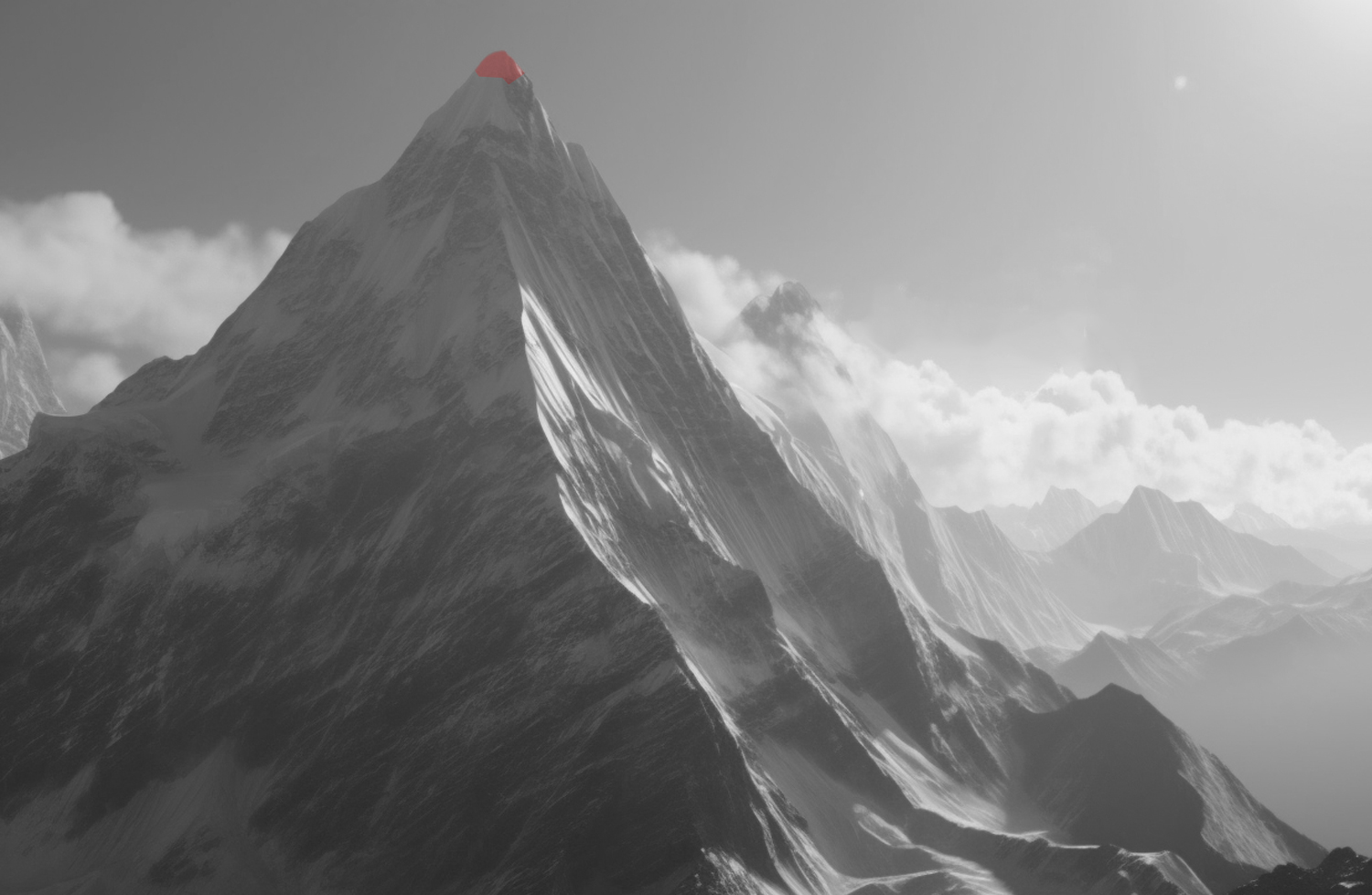

Andrew was on Top of the World!

Hello Traders,

I hope you are all well and have had a great trading week! Ardi here, writing on behalf of Andrew! The latest from Andrew’s adventure on Mount EVEREST is that his team has actually made the summit today at 5am local time!

He is in Camp 2 right now and is flying back to the city later tomorrow! I cannot wait to share that top of the mountain selfie with you all! You can read more about his journey here.

He has done what he set out to achieve this past year! Thank you all for being part of this journey with him and for all your prayers and positive thoughts and energy.

To celebrate his achievement, we are offering a flash sale on our Elite Annual memberships for those who are interested in trading alongside Andrew and our other mods over the next year.

For this weekend only, use the code SUMMIT23 to get 60% off our Elite Annual memberships. You will receive one full year of access to both of our chatrooms, our webinars, and our online curriculum, all of which are designed to take your trading to the next level!

The markets continue to travel the path of most pain: squeezing the shorts. This morning, the short interest in Qs was 13% lower than 20% earlier in the year, but still elevated. The Nasdaq is rallying hard, squeezing the shorts with no end in sight at the moment. But the question is: what is really driving the markets? Is it earnings? Flows? Liquidity? This time around it is liquidity and positioning. Let me explain that in detail.

You see, despite the narrative of “better than expected earnings”, the S&P has not done much since the earnings season started. From April 13th to May 16th, with 90% of companies reporting, the S&P was flat, as shown in the chart below. Therefore, the gain cannot be due to earnings.

What appears to have really led this is the excess liquidity the Fed injected into the system via its BTFD program. The chart below shows how correlated the movement in the S&P has been with the rates. As the rates went down, the market went UP! (Do note that the rates in the chart below are inverted.)

And lastly, the overly bearish positioning in the indexes is causing this rally to be more of a short squeeze! Understanding macro can really help traders with the bigger picture and their intraday trades. I hope my explanation was able to shed some light on this past week’s rally!

I wish you all a happy weekend. Make sure to stay in contact and simply reply to this newsletter if you have any questions!

To your success,

Ardi

PS: I love to stay connected with everyone on social media and each platform is of course different:

> Follow me on Instagram for the travelling trader lifestyle!

> Connect with me on LinkedIn for professional content.

> Follow me on Twitter for trade recaps and some memes!

> Subscribe to my YouTube channel for hot content from the BBT team.